I den här sektionen hittar du e-tjänster, blanketter, villkor, broschyrer och instruktioner på ett samlat ställe.

I den här sektionen hittar du e-tjänster, blanketter, villkor, broschyrer och instruktioner på ett samlat ställe.

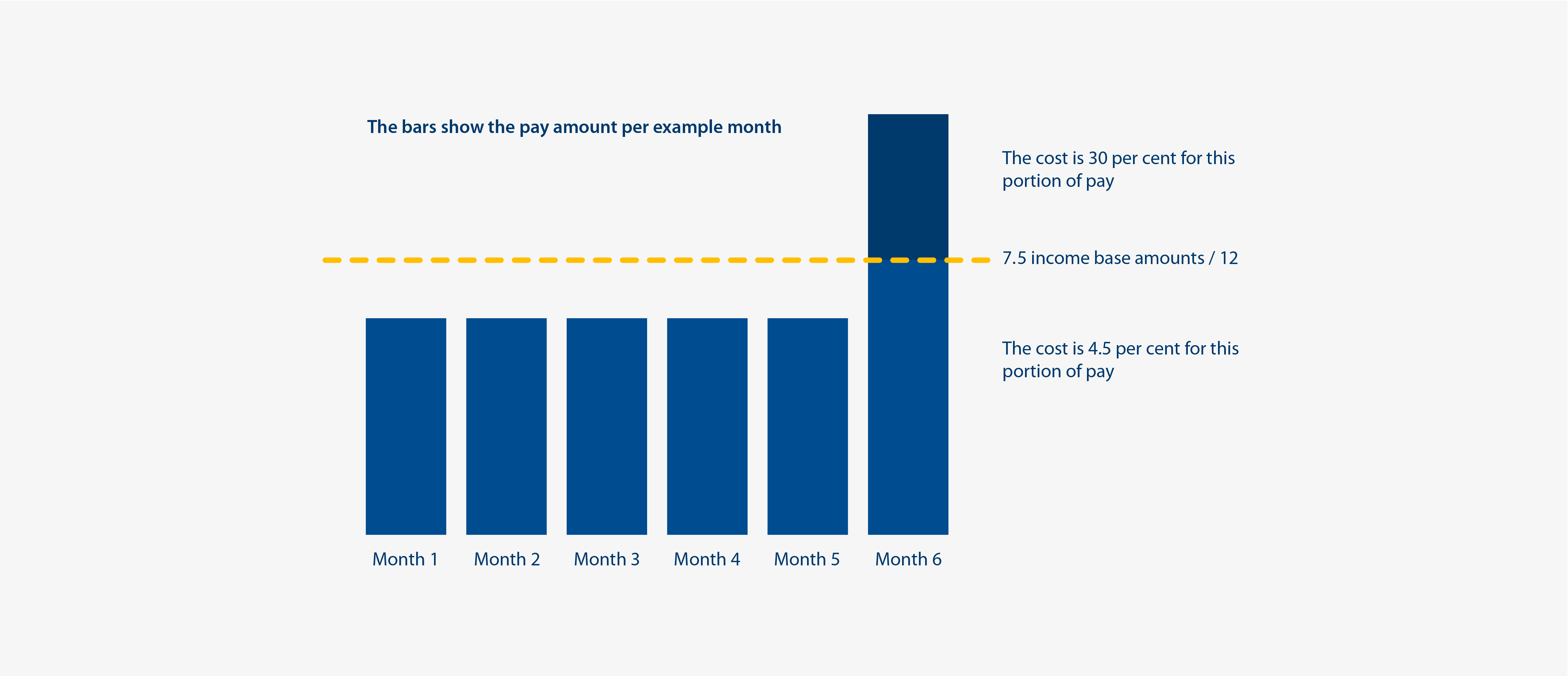

Pay should be reported for the month it was disbursed. This pay forms the calculation basis for the cost of the employees’ occupational pension each month. This means that the provision for the employees’ occupational pension may vary from month to month, depending on the amount of the pay disbursed.

With annual reporting, temporary pay peaks were not as noticeable, whereas now a higher pension allocation is made if pay is higher a certain month.

Example:

Erik has a regular pay of SEK 38,000. In an “ordinary” month, the cost of his occupational pension is 4.5 percent of SEK 38,000 = SEK 1,710.

In addition to his regular pay of SEK 38,000, Erik also receives a holiday allowance of SEK 5,000 and a retroactive salary increase of SEK 10,000 in June – totalling a payment of SEK 53,000.

With “Pay attributable to another month” certain pay categories that have been earned over a longer period but are paid as a lump sum are allocated to the months they have actually been earned. As a result. the pay for a certain month will fall below the cut-off point as the cost of the occupational pension is higher.

The following pay categories are reported as “pay attributable to another month”:

No other pay categories than those listed may be reported as “pay attributable to another month”, even if the pay is earned over several months (e.g. retroactive salary increase and holiday pay supplement).

When you report “pay attributable to another month”, the total amount paid for the month must be reported on the month of payment, amounts attributable to other months should then be marked. The procedure may differ slightly depending on the payroll system you use. If you report by manual input on Mina sidor, there is support in the interface.

Different rules apply for the months to which the various pay categories should be attributed.

1. Variable pay components that are based on the employee’s performance

The pay is distributed over the months it has actually been earned. While there is no upper or lower limit for the number of months to which the pay can be distributed when reporting, the pay can’t be distributed to months other than those in which it was actually earned.

Example:

Nils receives his performance-based pay every quarter. In June, he will receive his regular pay of SEK 25,000 and an additional SEK 12,000 for the last quarter. Nils's performance-based pay breaks down as follows:

April SEK 3,000

May SEK 7,000

June SEK 2,000

The total pay of SEK 37,000 is reported for June. SEK 3,000 is attributed to April and SEK 7,000 to May. The remaining SEK 27,000 remains attributed to June.

2. Bonuses, profit-sharing, gratuities and similar

The pay is distributed over the months it has actually been earned. While there is no upper or lower limit for the number of months to which the pay can be distributed when reporting, the pay can’t be distributed to months other than those in which it was actually earned.

Example:

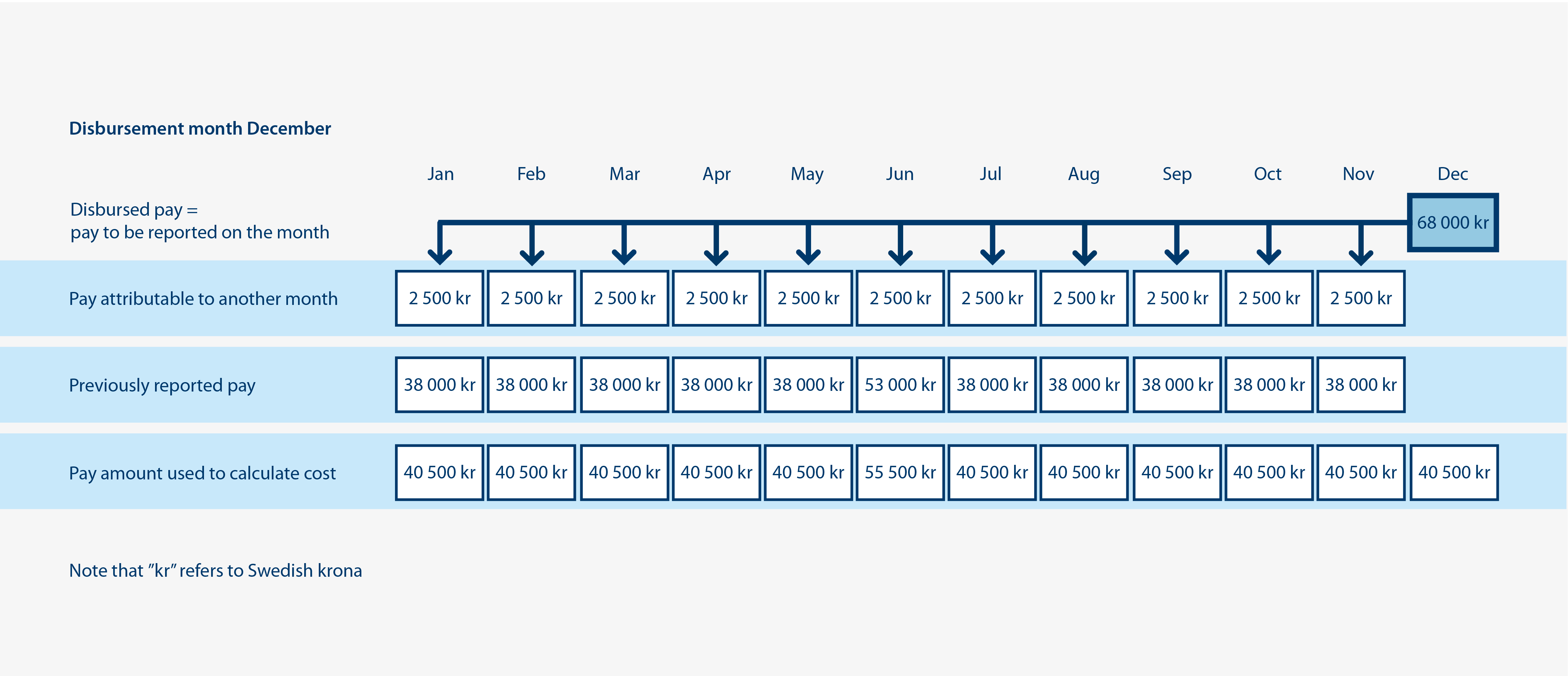

In December, Erik's pay was SEK 68,000 – a regular salary of SEK 38,000 and a full-year bonus of SEK 30,000. As the bonus was earned in the whole year, it should be allocated to all months of the year – “attributed”.

SEK 68,000 is reported for December. SEK 2,500 is marked as “pay attributable to another month” for each of the eleven months before the month of payment. The bonus for December is included in the pay reported for December and should not be attributed as it has already been reported for the month it was paid.

The pension premium for December is calculated at SEK 38,000 + SEK 2,500 = SEK 40,500, instead of SEK 68,000. For the previous months of that year, SEK 2,500 is added to the pay previously reported for each month and a new cost is calculated and invoiced for those months.

3. Payment of saved days' holiday leave earned in the previous year, when the employment ends

Saved days of holiday leave earned in the previous holiday year are divided equally over the twelve months preceding the month of the last day of employment (regardless of which day of the month it is).

If the employment was shorter than 12 months, the payment for the saved days of leave shall be divided equally over the months of the employment.

Example:

Erik's last day of employment is in February 2025 and he receives his final pay in March 2025. SEK 12,000 of the final pay is payment for saved days of holiday leave from the previous year and is therefore processed as pay attributable to another month.

The SEK 12,000 must be attributed to the 12 months preceding the month in which the last day of employment occurs.

Pay should not be attributed to the month of payment.

Pay components related to the month of payment neither should nor can be marked “pay attributable to another month”.

Pay cannot be attributed to a future month.

Salary payments for specific months should be reported – pay for months in the future can therefore not be reported.

The portion of the pay amount marked “pay attributable to another month” cannot exceed the total pay amount reported for the month.

It is not possible to attribute pay from the same payment month multiple times to the same month for the same individual.

If the paid salary contains multiple pay components to be allocated to one and the same month, add up the total amount to be attributed to that month and enter it.